Inheritance tax overhaul part of radical Liberal Democrat plans to tackle wealth inequality

Liberal Democrat Conference last week voted for a motion designed to spread opportunity, power and wealth more fairly throughout society and to give everyone a stake in the UK's economic success. The party expects these reforms to raise an additional £15 billion per year, though this is likely to grow as the rate of wealth passed down increases in the coming years.

Motion proposals include:

- Overhauling inheritance tax - taxing recipients progressively on all large gifts received at the same rates as income from employment, above a generous tax-free lifetime allowance, instead of the current system of levying tax on the value of an estate left behind

- Taxing capital gains and dividends - equalising the tax treatment of wealth and work by taxing capital gains and dividends through the income tax system

- Reforming pension tax relief - introducing a flat rate of relief on pension contributions, thus rebalancing relief towards lower earners; and limiting the tax-free lump sum the wealthiest can withdraw from their pension pots

- Lifelong learning and a "Citizens Wealth Fund" - using the revenues from wealth taxation to invest in public services, fund an ambitious programme of lifelong learning to prepare workers for the future economy, and establish an independent Citizens Wealth Fund to invest on behalf of the country

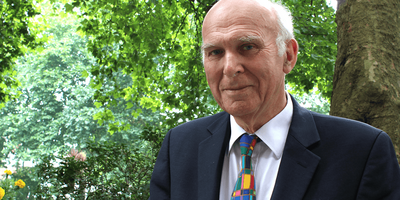

Liberal Democrat leader Vince Cable said "While the Conservatives talk about burning injustices, Liberal Democrats take them seriously. That is why my first major speech as leader was on inequality, in particular the widening inequalities of wealth and opportunity between the generations that risk tearing up the social contract. This motion represents a serious and informed response to this challenge. They follow closely on the work of the Resolution Foundation and the IPPR, which have reached similar conclusions on the policies needed to address Britain's deep economic divides.

While it is increasingly clear that taxes will have to rise if we are to afford the crucial public services and investment we all rely on, hard-pressed workers should not be the only ones paying up. It is time to put Britain's wealth to work."

Baroness Kramer, Liberal Democrat Treasury Spokesperson said "Everyone wants better opportunities for their children and grandchildren. But while this used to be taken for granted, belief in intergenerational mobility is fading fast. The proposals we are setting out today are a serious step towards redressing the economic imbalances between the generations, which is vital to achieving that goal. To put the nation's wealth to work, we would establish an independent Citizens Wealth Fund - drawing on the successful experience of countries such as Canada and Norway - and launch an ambitious programme of lifelong learning to prepare workers for the future economy."